Blog /

Banning employer-paid virtual health care could hinder access to essential health services for 10 million Canadians

Banning employer-paid virtual health care could hinder access to essential health services for 10 million Canadians

Communications about virtual care in the public system should clearly state that employer-funded virtual health options are allowed.

What is Employer-Paid Virtual Health Care and Why Is It Important for Canadians?

Employer-paid virtual care, provided as part of an employee benefit plan, allows Canadians to access medical consultations and treatments remotely, typically through online platforms, phone or video calls. These services are intended to complement existing public health services as well as offer support to the millions of Canadians without regular access to a medical professional.

Employer-paid virtual care supports 10 million Canadians’ access to healthcare, reduces the strain on our overburdened medical system and saves public funds.

The Issue

In 2023, Ottawa announced its intention to produce an Interpretation Letter on the Canada Health Act to rightly close certain loopholes that have led to Canadians being charged out-of-pocket for medically necessary services. The letter is expected to be released soon.

However, unless a clear exemption is provided, employers will no longer be able to offer virtual care through their workplace benefit plans. This will force millions of Canadians into already overburdened ERs and walk-in clinics for the treatment of common ailments that could have been addressed remotely.

The Facts

Canadians do not pay for these services out of their pocket – they are covered by the employer.

- Through secure videoconferencing platforms, employees and their family members have unlimited access to virtual care without having to pay for consultations.

- These services are intended to complement existing public health services and offer support to the millions of Canadians without regular access to a medical professional.

- Approximately 10 million people in Canada currently have access to virtual care platforms through an employer-funded health benefits plan.

Employer-paid virtual care adds capacity to and reduces the strain on our health system.

- Over 50% of people using some virtual care providers do not have access to a family doctor. Without this service, these Canadians would have to relay almost solely on walk-in clinics and the ER.

- Providers offering virtual care do so in addition to their work in the public system and often outside of traditional family practice hours. This means virtual care services add capacity to our health system – at no cost to patients or governments.

Employer-paid virtual care saves governments money.

- By preventing unnecessary emergency room visits and hospitalizations, virtual care saves governments an estimated $52 per consultation, according to a 2022 AppEco Study.

People value their employer benefits – governments should not be eroding them.

- Nearly 90% of Canadians believe their workplace health benefits are a positive example of employer support for healthcare.

- At a time when Canadians face significant economic pressure, employer benefit plans help make life more affordable. In fact, 84% of Canadians say workplace plans have helped them with the cost of living.

- Eroding these benefits would also negatively affect businesses, employers and employees by decreasing workforce productivity and increasing healthcare costs for individuals and employee absenteeism rates.

What’s Next

The government should focus on the core issue: Canadians paying out of pocket for necessary medical services. This can be done while still allowing employers to offer virtual care benefits at no extra cost to patients.

Any communications around the provision of virtual care in the public system should explicitly state that employer-funded virtual care is permitted.

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

Canadian Chamber Addresses Bill C-58 Before Senate Committee

Canadian Chamber Addresses Bill C-58 Before Senate Committee

On June 12, 2024, we addressed Bill C-58, the proposed ban on anti-replacement workers, before the Standing Senate Committee on Social Affairs, Science and Technology.

On June 12, 2024, Robin Guy, Vice President and Deputy Leader of Government Relations at the Canadian Chamber of Commerce, presented before the Standing Senate Committee on Social Affairs, Science and Technology regarding Bill C-58.

Representing 400 Chambers and Boards of Trade and approximately 200,000 businesses nationwide, we expressed the Chamber’s grave concerns about the proposed ban on anti-replacement workers and highlighted the potential negative impacts on small businesses, workers, and Canadian families who rely on essential services provided by federally regulated sectors.

The full remarks and video recording can be found below.

Good afternoon, Madame Chair and honourable Senators,

On behalf of the Canadian Chamber of Commerce, our 400 Chambers and Boards of Trade, and approximately 200,000 businesses across the country, thank you for the opportunity to participate in today’s discussion as the Committee reviews Bill C-58, the Government’s proposed ban on anti-replacement workers.

Ultimately, the issue relates to who will protect the interests of the small businesses, the workers whose jobs are threatened and the Canadian families who suffer shortages or higher costs as a result of labour disruptions. Bill C-58 is a threat not only to businesses and entrepreneurs but also to the millions of Canadians who rely on vital services provided by companies operating in the federally regulated sector. As a result, the Canadian Chamber has grave concerns regarding this legislation.

In Q4 of last year, Canada lost 926,400 hours to labour disputes. To put that in context, it’s the most in any quarter of the last 18 years. In fact, a recent Scotiabank report stated that Canada is losing more hours worked to striking workers than it lost at any point during pandemic restrictions. And all signs indicate more labour unrest is forthcoming.

The Government’s own discussion paper on anti-replacement worker legislation stated “the majority of studies suggest that when a province prohibits replacement workers, [it] is associated with more frequent strikes and lockouts, at least in some sectors.” If that research is correct, the ban could harm the economy by subjecting Canada’s federally regulated telecommunications and transportation infrastructure to even more frequent and lengthy disruptions.

Replacement workers allow organizations in rail, ports, telecom and air to sustain a basic level of “lights on” continuity that preserves critical services for Canadians. These workers are an essential backstop for our economy, able to step in on a temporary basis — in the interests of Canadians — until a work stoppage ends.

There are serious ramifications for all Canadians if we prohibit these workers from keeping those lights on.

Outages to our telecommunications infrastructure that we all count on to be fast and reliable are often resolved without issue. But, during a strike, replacement workers would not be able to fix problems. Small businesses, including coffee shops or restaurants would lose their ability to process payments, while Canadians wouldn’t be able to reach loved ones.

Consider as well that Canadians across the country rely on commuter public transit to get to where they’re going, including many who rely on rail service to get to and from work each day. Approximately 70 million passengers use rail each year, including along our biggest corridors in the Greater Toronto, Montreal and Vancouver areas. During a rail strike, without replacement workers, we could not ensure trains continued to move on a reliable schedule. Tens of thousands of Canadians would be forced to find alternative ways to get to where they needed to go.

Air travel would also be significantly impacted, especially in the many communities that can only be accessed by plane. If pilots, baggage handlers or the workers who fuel planes were to go on strike, replacement workers would not be able to ensure Canadians could keep moving. Canadians going on vacation would need to cancel their trips. Workers wouldn’t be able to get home. Canadians in fly-in communities would be cut off.

Simply put, there is no need or benefit from banning the temporary use of replacement workers.

The role of the Government of Canada should be to defend the public interest, not to promote the interests of one of the parties in a strike. Canada’s long-established collective bargaining system has been carefully crafted to encourage employers and unions to reach agreements at the bargaining table. This new legislation would tip the balance of power and potentially inflict severe economic consequences on Canadian communities, businesses and workers.

While the Canadian Chamber fundamentally does not support Bill C-58, if they do support, we would encourage Senators to consider amending this legislation.

At a minimum, we would recommend that Senators include an exemption for using replacement workers in instances that are in the national economic interest of the country.

We also recommend that Senators amend the proposed legislation to begin at the notice of dispute rather than at the notice of bargain.

To find the right balance in C-58, and ensure critical infrastructure continues to operate, the Senate should remove the restrictions on transferring employees between workplaces. It can achieve this by deleting clause 9(4)(c).

Additionally, we would urge Senators to reverse amendments on its enforcement date to 18 months, to allow time for its proper implementation.

As stated by the Minister of Labour, “our credibility as a trading nation depends on the stable operation of our supply chains. We must do everything we can to preserve that stability.” We couldn’t agree more. However, this bill will do the opposite.

Thank you again for the opportunity to contribute to this critical topic. I look forward to answering your questions.

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

Canadian Chamber Addresses Federal Regulatory Modernization Initiatives Before OGGO Committee

Canadian Chamber Addresses Federal Regulatory Modernization Initiatives Before OGGO Committee

On June 12, 2024, we addressed the Federal Regulatory Modernization Initiatives before the Standing Committee on Government Operations and Estimates (OGGO).

On June 12, 2024, Alex Greco, Senior Director of Manufacturing and Value Chains at the Canadian Chamber of Commerce, addressed the Standing Committee on Government Operations and Estimates (OGGO) on Federal Regulatory Modernization Initiatives.

Representing 400 chambers of commerce and over 200,000 businesses, we emphasized the need for streamlined, efficient regulations to foster economic growth and business investment in Canada, and highlighted the regulatory burdens that stifle business operations, particularly for small enterprises, and called for a collaborative, transparent approach to regulatory reform.

The full recording and remarks can be found below.

Mr. Chair, Honourable Members:

It is a pleasure to once again appear before you on behalf of 400 chambers of commerce and boards of trade and more than 200,000 businesses of all sizes from all sectors of the economy and from every part of the country.

As I have already had the chance to share an opening statement with this committee and I am looking forward to taking as many questions as I can from you, I will keep my opening remarks fairly brief.

As I mentioned in my last appearance, the regulatory burden is an ongoing issue for Canadian business. It stifles business growth and investment in Canada. According to the Organization for Economic Co-operation and Development (OECD), Canada ranks second last among a group of 31 countries in terms of business investment growth.

The relatively poor investment performance of Canada compared to other countries suggests that businesses see less opportunity in Canada, spelling trouble for the country’s future economic growth prospects.

While our members frequently bring forward specific regulatory challenges, they all lead to a broader general theme: the government is moving too slowly on regulatory modernization, while taking a piecemeal approach. As a result, the complexity of our regulatory system continues to stifle economic growth.

Canada also has a complex network of overlapping regulations from all levels of government that make a lot of things more expensive and difficult than they need to be for businesses.

Every hour and every dollar businesses spend dealing with redundant paperwork and confusing compliance issues is an hour or dollar not spent on running and growing a business. This is especially true for small businesses, which often lack the specialized staff and financial resources of larger companies to deal with regulation and compliance.

Moreover, while some steps have been taken to strengthen interprovincial trade with the launch of the Canadian Internal Trade Data and Information Hub, we have missed opportunities to reduce interprovincial trade barriers. Internal trade barriers cost Canada’s economy more than $14 billion each year. Progress on strengthening on internal trade is necessary to reducing barriers, ensuring an open market and the free flow of people, and goods across Canada.

Regulatory modernization does not mean de-regulation or lessening of environmental, labour, safety or any other important societal standards. Rather, it means writing regulations smarter, more efficiently, and in a manner that focuses on economic growth and business investment.

Now is time for the government to move boldly and urgently on a collaborative, transparent, whole-of-government approach to regulatory reform.

The three recommendations I put forward in my last appearance were as follows:

First, the government must move to implement an economic and competitiveness mandate to federal regulators.

Second is regulatory alignment across domestic and international jurisdictions.

Finally, the government should pledge to provide regulatory certainty to businesses.

The Canadian Chamber also recently submitted recommendations to the President of the Treasury Board regarding the reignition of the Canada-United States Regulatory Cooperation Council (RCC).

Our relationship with our most important trading partner is of the utmost priority. And it was good to see yesterday that Canada and the United States reaffirmed their shared commitment to regulatory cooperation. In such a competitive global environment, we need to streamline and align regulatory processes, promote trade, pursue mutual recognition, and enhance the efficiency of cross border operations between our two countries.

A reinvigorated RCC will do just that, while promoting Canadian prosperity, sustainability, and safety.

With nearly $3.5 billion CAD of trade crossing our border every day, we must do everything we can to ensure regulatory alignment that will support further growth in trade and market access.

That said, I cannot stress enough that for Canada to be a competitive trading partner globally, we must have our own house in order. This will require not just regulatory harmonization with the United States but addressing the web of overlapping regulations between Canadian jurisdictions.

As I said previously, when regulations are more consistent between jurisdictions, businesses are better able to trade within Canada and beyond.

Thank you for the opportunity to bring further testimony to the Honourable members of this committee. I look forward to your questions.

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

Canadian Chamber Addresses Amendments to Bill C-59 Before Senate Committee

Canadian Chamber Addresses Amendments to Bill C-59 Before Senate Committee

On June 11, 2024, we addressed the amendments adopted by the House of Commons to Bill C-59 before the Standing Senate Committee on National Finance.

On June 11, 2024, our Senior Director of Natural Resources and Sustainability, Bryan N. Detchou, and our Director of Policy and Government Relations, Liam MacDonald, appeared before the Standing Senate Committee on National Finance to discuss the amendments adopted by the House of Commons to Bill C-59. Representing over 400 Chambers and Boards of Trade and approximately 200,000 businesses nationwide, they voiced significant concerns about about the retroactive nature of the proposed Digital Services Tax, as well as the recent amendments to the Competition Act included in the bill.

The full remarks and video recording are available below.

_____________________

Mr. Chair, Honourable Senators:

On behalf of the Canadian Chamber of Commerce, our 400 Chambers and Boards of Trade, and approximately 200,000 businesses across the country, thank you for the opportunity to participate in today’s discussion as this Committee reviews the amended version of Bill C-59.

We were pleased to present our views before the Senate Committee on National Finance on March 20 and the House of Commons Finance Committee on April 11 as they studied Bill C-59. As you know, we raised concerns at that time about the retroactive nature of the proposed Digital Services Tax, as well as significant changes being introduced to the Competition Act.

However, on Tuesday, April 30, during the House of Commons Standing Committee on Finance’s clause-by-clause review of Bill C-59, we were surprised and disappointed to see significant, new amendments to the Competition Act adopted without prior warning and without consulting businesses of all sizes that will be affected.

We believe these proposed changes will have a long-term negative impact on the economy and must be thoroughly studied and debated by Parliament, and carefully reviewed by officials and legal experts inside government. A clear understanding of the bill’s unintended consequences is essential.

Bill C-59 is the second piece of legislation in only a few months that will amend the Competition Act. It also contains the second set of proposals that were introduced without warning, substantially amended at the last minute, and then moved through parliament with hardly any debate.

This piecemeal and ad-hoc approach to reforming our competition laws means poor public policy choices that will negatively affect Canadians. After all, the Competition Act applies to all Canadian businesses and is one of Canada’s most important marketplace framework policies.

An amendment to Bill C-59 proposes to add structural presumptions for merger review consistent with those set forth in the 2023 U.S. Federal Trade Commission (FTC) merger guidelines.

As we noted in our first appearance before the committee on C-59, these are just guidelines – they carry no force of law and have not been recognized by any U.S. courts, who continue to rely on well-established, effects-based anti-trust principles.

These guidelines have also been widely criticized by competition experts. An article published by the American Bar Association describes them as “anachronistic, constituting a marked retrenchment to long-discarded approaches and rejected legal positions.”

Further, the amendments introduce language and figures that are inconsistent with the

Competition Bureau’s merger enforcement guidelines and practice. If this Committee does not remove the new amendments, then we have included proposed language in our submission to ensure, at a minimum, that Canadian law remains consistent with Canadian enforcement guidelines and definitions.

The consensus among anti-trust experts since the 1970s has been that measures of market structure, like the Herfindal-Hirschman Index, say little about competitive conditions because market power is an outcome, not an immutable determinant of competition in an industry or market. Many firms gain market power precisely because they were operating in highly competitive markets and were able to out-compete rivals.

Lowering the burden of proof for enforcement is the wrong solution to the fact that proving competitive harm is difficult in today’s dynamic markets. This change will lead to enforcement being taken against benign or pro-competitive conduct which competition laws are meant to protect.

Finally, we would like to address the new language on deceptive marketing practices when it comes to Environmental Claims.

The Canadian Chamber and our members are committed to decarbonizing our economy as we pursue common Net-Zero targets. We strongly oppose any effort to mislead consumers or greenwash in pursuit of these goals. However, we believe the proposed amendments are excessively broad and represent a significant shift from the traditional scope of competition law.

Our diverse membership is justifiably concerned about the uncertainty introduced by the new, inherently vague standard. This standard could impact any company making public statements or warranties regarding environmental and climate change matters. We urge you to carefully consider the Commissioner of Competition’s advice to fully withdraw this amendment.

Decarbonizing Canada’s economy is one of the greatest challenges and opportunities of our time. Governments need to collaborate with businesses to drive the innovation necessary to achieve our ambitious climate goals. In light of this, we recommend that the Senate withdraw amendment section 74.01(1)(b.2) to the Competition Act from Bill C-59 and engage with the business community and other constituents to determine a path forward that prevents misrepresentations without creating uncertainty or additional bureaucratic burden for business.

In conclusion, Canada’s business community recognizes the need to modernize our country’s decades-old Competition Act to ensure it remains relevant in a rapidly evolving economy, however the latest proposed changes will bring Canada out of step with international best practices and raise regulatory compliance costs, including on SMEs, and will likely reduce rather than increase competition.

Thank you

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

Canadian Chamber Addresses Proposed Amendments to the Impact Assessment Act Before Senate Committee

Canadian Chamber Addresses Proposed Amendments to the Impact Assessment Act Before Senate Committee

On May 28, 2024, we addressed the proposed amendments to the Impact Assessment Act (IAA) and their implications for Canadian businesses and investments before the Standing Senate Committee on Energy, the Environment and Natural Resources.

On May 28, 2024, our Senior Director of Natural Resources, Environment & Sustainability, Bryan Detchou, addressed the Standing Senate Committee on Energy, the Environment and Natural Resources to discuss the proposed amendments to the Impact Assessment Act (IAA) and their implications for Canadian businesses and investments.

Canada is uniquely positioned to lead the global energy transition due to its abundant natural resources and strong regulatory framework. However, the challenges posed by lengthy project approval processes hinder Canada’s ability to meet its net-zero goals and to become a reliable global supplier of responsibly sourced natural resources. In his remarks, Detchou underscored the need for regulatory certainty to attract investment and support long-term projects. He also addressed the recent Supreme Court ruling on the IAA, urging for amendments that provide clarity and predictability to ensure Canada’s competitiveness in the global market.

The Canadian Chamber of Commerce advocates for a collaborative approach to create a more predictable, transparent, and efficient regulatory framework, essential for achieving Canada’s economic and environmental objectives.

The full remarks and video recording can be seen below.

Mr. Chair and Honourable Senators,

Je vous remercie de me donner l’occasion de participer à la discussion d’aujourd’hui au nom de la Chambre de commerce du Canada, afin d’examiner les modifications proposées à la Loi sur l’évaluation d’impact et leurs implications pour les entreprises et les investissements canadiens.

Senators, allow me to begin my remarks by stating the obvious. No country is better positioned than Canada to lead the global energy transition. With its vast natural resources, skilled workforce, strong regulations, commitment to ESG, and focus on reconciliation with indigenous communities, Canada stands out as a responsible and reliable global supplier.

Canada has grand ambitions and the talent and natural resources to see them fulfilled. However, we also have a record of getting in our own way. Canada will not meet its net-zero goals, let alone become a reliable global supplier of responsibility sourced natural resources, if we cannot get major projects built. Project approvals cannot continue to take 10 or more years — whether what’s proposed is a major Carbon Capture Utilization and Storage project that would continue to reduce emissions or a transportation gateway that would help ensure Canadian businesses can get goods to market reliably and efficiently. Regulatory certainty is essential to generate the investment and growth our nation requires, which cannot be achieved without private sector partners committed to long-term projects. Though governments have made several commitments in recent years to improve regulatory efficiencies, streamline permitting for major projects and clear permitting backlogs, the status quo remains. This multijurisdictional process certainly has many actors involved, but the federal government has a unique role to play to ensure Canada rids itself of the reputation of a place where major projects can’t get built.

Consider the Electric-Vehicle battery industry. The federal government aims to make Canada a major player in the global EV supply chain by investing heavily in EV production. Alongside Quebec and Ontario, they have committed tens of billions to attract major automakers. Critical minerals like lithium, cobalt, nickel, and graphite are essential for EV batteries, but since 2005, only four new critical mineral mines have opened in Canada. Government data shows that to support domestic EV battery production, Canada must open over 20 new mines by 2035—five times faster than the current rate. This is challenging, as the typical mine takes 10 to 15 years to pass regulatory approvals and community consultations. Canada’s EV transition is hindered by these regulatory and logistical challenges in utilizing our mineral resources.

Last October, when the Supreme Court of Canada released its judgment, finding parts of IAA unconstitutional, it simply underscored the ongoing challenges that businesses in Canada face due to regulatory uncertainty. In a world where capital is highly mobile, countries that can offer regulatory clarity and efficiency will attract more investment. To remain competitive, Canada must demonstrate that it can deliver major projects in a timely and predictable manner.

In response to the court’s judgement, the Government of Canada pledged “surgical” amendments. However, the efficacy of this surgical intervention remains uncertain. As this committee conducts its study, certain key questions demand attention:

- Will the amendments provide the certainty and predictability desired by project proponents?

- Have the amendments sufficiently addressed the pivotal concerns outline by the Supreme Court?

- What are the consequences if the amendments are insufficient?

To answer the first question, the proposed amendments to the IAA show that the government’s main priority, after the Supreme Court’s ruling, was to ensure the IAA’s constitutionality rather than improve clarity on its applicability, timelines, and decision- making authority. As a result, a key opportunity to create a regulatory environment that boosts business confidence and minimizes risks has been missed.

To address the second and third questions directly, our primary concern is that if the amended Act is finalized in its current state, it may again face constitutional challenges from the provinces. Meanwhile, as companies and investors once again await clarity, many will either keep their funds on the sidelines or invest them in other countries, hindering Canada’s economic prosperity and energy transition.

La rhétorique et l’ambition ne suffiront pas à faire construire de grands projets au Canada. La réalisation de nos objectifs économiques et environnementaux exige une véritable collaboration entre les secteurs privé et public. Il est impératif de reconnaître que la réussite de ces projets est intimement liée à la croissance économique et à la productivité de notre pays. Bien que le Canada soit prêt à mener la transition énergétique mondiale, cette position n’est pas garantie et ne doit pas être présumée.

Getting the amendments to the IAA right is essential.

The Canadian Chamber of Commerce believes that an amended IAA, developed through collaborative efforts, can create a more predictable, transparent, and efficient regulatory framework. We are eager to support the government in its aims to establish a modern and efficient regulatory system that responds to the needs of industry and respects the jurisdictions of all levels of government.

Thank you.

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

Canadian Chamber Addresses Impact of Climate Change on Canada’s Financial System Before House Committee

Canadian Chamber Addresses Impact of Climate Change on Canada’s Financial System Before House Committee

On May 23, 2024, we addressed the critical impacts of climate change on Canada’s financial system before the House of Commons Standing Committee on Environment and Sustainable Development.

On May 23, 2024, our Senior Director, Fiscal and Financial Services Policy, Jessica Brandon-Jepp and Senior Director, Natural Resources, Environment & Sustainability, Bryan Detchou, presented to the House of Commons Standing Committee on Environment and Sustainable Development on the critical impacts of climate change on Canada’s financial system.

They emphasized the urgent need for increased investments in net-zero solutions and highlighted the importance of a competitive investment environment. They advocated for clear guidance and data to accelerate net-zero investments, the adoption of a common definition for net-zero investments, and the standardization of climate-related disclosures.

The video recording and full remarks can be seen below.

Thursday, May 23, 2024, 3:30 p.m. to 5:30 p.m.

Room 425, Wellington Building, 197 Sparks Street

Jessica Brandon-Jepp – Senior Director, Fiscal and Financial Services Policy

Bryan Detchou – Senior Director, Natural Resources, Environment & Sustainability

Mr. Chair and Honourable Members

Je vous remercie de nous donné l’occasion de participer à la discussion d’aujourd’hui au nom de la Chambre de commerce du Canada, afin de parler de l’impact de l’environnement et du climat sur le système financier canadien.

The Canadian Chamber of Commerce represents 200,000 Canadian businesses through more than 400 local, provincial, and territorial chambers and boards of trade, and over 120 trade associations. We represent members in every sector of the economy, all sizes of business, across all regions of the country.

Tout d’abord, permettez-moi de souligner que la Chambre de commerce du Canada et ses membres, d’un océan à l’autre, reconnaissent l’importance primordiale d’atteindre nos objectifs nets zéro et s’engagent à jouer leur rôle dans l’effort collectif de lutte contre le changement climatique. Il est important pour nos membres de réussir la transition vers l’énergie propre, car nous représentons non seulement les secteurs et les entreprises les plus impliqués dans cette transformation, mais aussi les communautés de tout le pays qu’ils soutiennent.

Climate change looms as a significant structural change impacting the economy and the financial system. As one of the most critical issues of our time, it demands collective action across all sectors. According to the SFAC Secretariat, Canada faces an annual investment gap of $115 billion to achieve its net-zero transition goals. While the government has made significant strides in climate investments, this gap persists. With the federal government nearing its fiscal capacity, it is imperative that provinces and municipalities substantially increase their climate-oriented expenditures. Business capital investments in climate and cleantech reached $14 billion last year, as reported by RBC. However, business capital investment needs to increase, as do contributions from public markets, private equity, and venture capital. To fund, scale, and support innovative green technologies, a collaborative effort between government, industry, and investors is essential. This cooperation will equip the Canadian economy with the necessary tools and support to realize its net-zero ambitions.

Increasing investment in net-zero solutions starts by ensuring that Canada is a competitive environment for investment writ large. New tax increases that foster uncertainty and phase outs of incentives that stifle investment and signal to the world’s innovators to look elsewhere, are not helping to attract or retain the kind of entrepreneurs and investors that are going to advance bleeding edge, made-in-Canada net-zero solutions.

Additionally, investors require clarity, guidance, and data about opportunities to invest in Canada’s net-zero transition to in order to accelerate capital flows, create the jobs of tomorrow and grow our economy. Without access to this information and these tools, Canada cannot be globally competitive in fueling net-zero investment.

Canada should adopt a common definition for what constitutes investment that supports net-zero. Greater transparency on Canada’s transition plans would help track progress, facilitate accountability and help the private sector plan investment strategies. The Sustainable Finance Action Council set out recommendations on establishing a Canadian Sustainable Finance Taxonomy, which should be uniformly adopted by stakeholders across Canada, including financial institutions to ensure sound capital allocation.

In addition, the development and standardization of climate-related transition and physical risk disclosures, ideally with as much harmonization as possible while accounting for Canada’s unique challenges and opportunities, will enable organizations to track and accelerate their progress and provide information and confidence to investors. Initial guidance issued by OSFI is a positive step.

It is worth noting that many of Canada’s largest federally-regulated financial institutions participated on the federal government’s Sustainable Finance Action Council, which has made a variety of recommendations to advance progress towards developing a building a strong and successful sustainable finance marketplace. These recommendations have not yet advanced and they require urgent action from government to ensure Canada is not falling behind our peers in attracting investment and driving the economy of tomorrow.

In the absence of standardized, Canadian-specific guidance, a patchwork of various standards and guidance has emerged, within Canada and around the world, leaving businesses and investors frustrated and confused as they try to plan and navigate their net-zero ambitions. All the while, Canada gets farther from achieving its goals and attracting the kind of investment that will grow and sustain our economy for generations to come.

Businesses and investors are eager to partner with government to accelerate Canada’s net-zero ambitions but government leadership is required to advance a standardized, Canadian-made framework for sustainable finance success. The Canadian Chamber’s Green Transition Finance Council and Net-Zero Council are ready and willing to support.

My colleague Bryan and I will be pleased to answer your questions.

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

Unleashing Canada’s Energy Advantage: A Collective Vision We Can Achieve

Unleashing Canada’s Energy Advantage: A Collective Vision We Can Achieve

By Perrin Beatty, P.C., O.C., President and CEO of the Canadian Chamber of Commerce, and Lisa A. Baiton, MBA, ICD.D, President and CEO of the Canadian Association of Petroleum Producers

A cursory glance at most of Canada’s economic indicators reveals a troubling reality — our great nation is on the cusp of decline. Per capita GDP has stagnated, showing less than 1% growth between the beginning of 2018 and the end of 2023[i]. According to the OECD, Canada is projected to have the lowest real GDP per capita growth among all 38 advanced countries over the next four decades[ii]. Additionally, over the past seven years, Canada has ranked 44th out of 47 countries in investment growth rates tracked by the OECD[iii]. The Bank of Canada has issued warnings, citing weak productivity and low business investment as a national emergency.[iv]

As a result of all this, Canada’s living standards are slumping. A recent poll by Pew Research found that 75% of Canadians believe that our children will have a lower standard of living than we do[v]. Moreover, amidst rapid and tumultuous geopolitical transitions in trade, economics and energy, Canada’s longstanding relationships with trading partners and our reputation as a G7 member and NATO partner are at risk.

Canada’s economic challenges are large and many and easily identifiable. But where are the solutions? A recent report on the economic impact of Canada’s conventional oil and natural gas sector unequivocally points to some.

The study, conducted by the Canadian Chamber of Commerce’s Business Data Lab, illuminates the often-underestimated potential of Canada’s conventional oil and gas sector to address our most pressing economic and social issues.

The conventional sector (which excludes the oil sands) represents about two-thirds of total oil and gas investment in the country. It contributes significantly to Canadian prosperity while also playing a vital role in environmental stewardship and energy security. Plus, it operates extensively across the nation, serving as the economic backbone of numerous communities.

The sector is deeply undervalued. Consider the Canadian Chamber’s findings on industry employment: Canada’s conventional oil and gas sector supports 493,000 direct, indirect and induced jobs nationwide, accounting for 3% of total national employment. And for every million dollars spent in the sector, nearly five jobs are supported, a ratio that compares favourably to other sectors of the economy.

These are well-paying jobs, too. At $90 an hour, the average conventional oil and gas industry worker earns over twice the national average wage for other occupations.

The industry’s total economic contribution extends to government revenues as well. In 2022, the conventional sector and the oil sands contributed $45 billion to government coffers in the form of tax and royalty payments, enabling funding for essential services and infrastructure benefiting all Canadians.

Additionally, the conventional sector plays a pivotal role in maintaining a positive balance of trade for Canada. Without conventional oil and gas exports, Canada would face a significant trade deficit, impacting economic stability, currency value and international competitiveness.

The solution to our challenges is staring us in the face. And unlocking Canada’s energy advantage and maximizing the benefits of our natural resources requires just four steps — steps we truly can follow.

First, we can adopt a pragmatic approach to energy transition, investing in technology, facilities and infrastructure on an unprecedented scale.

Second, we can streamline our approach to major projects, ensuring timely approvals and permitting processes.

Third, we can create an attractive investment climate by reforming our regulatory regime and actively promoting major investment opportunities.

Finally, we can capitalize on the opportunity presented by liquefied natural gas (LNG), one of the most promising avenues for sectoral growth and a significant contributor to global emissions reduction.

Canada’s conventional oil and natural gas sector is more than just an industry; it is a cornerstone of our economy, providing livelihoods for countless Canadians and showcasing our nation’s ingenuity and resilience. However, to unleash its full potential, we need to embrace innovation, foster collaboration, and advocate for policies that forward both prosperity and environmental stewardship.

The road ahead is challenging, but the potential rewards are immense. Together, policymakers and industry can harness Canada’s energy advantage and lead the world towards a more prosperous, equitable and sustainable future.

[i] OECD Data Explorer (2024)

[ii] Guillemette, Y. and D. Turner (2021), “The long game: Fiscal outlooks to 2060 underline need for structural reform”, OECD Economic Policy Papers, No. 29, OECD Publishing, Paris, https://doi.org/10.1787/a112307e-en.

[iii] GDP and spending – Investment (GFCF) – OECD Data OECD (2024), Investment (GFCF) (indicator). doi: 10.1787/b6793677-en (Accessed on 01 March 2024)

[iv] Bank of Canada (March 26, 2024) https://www.bankofcanada.ca/2024/03/time-to-break-the-glass-fixing-canadas-productivity-problem/

[v] Pew Research (2022) https://www.pewresearch.org/short-reads/2022/08/11/large-shares-in-many-countries-are-pessimistic-about-the-next-generations-financial-future/

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

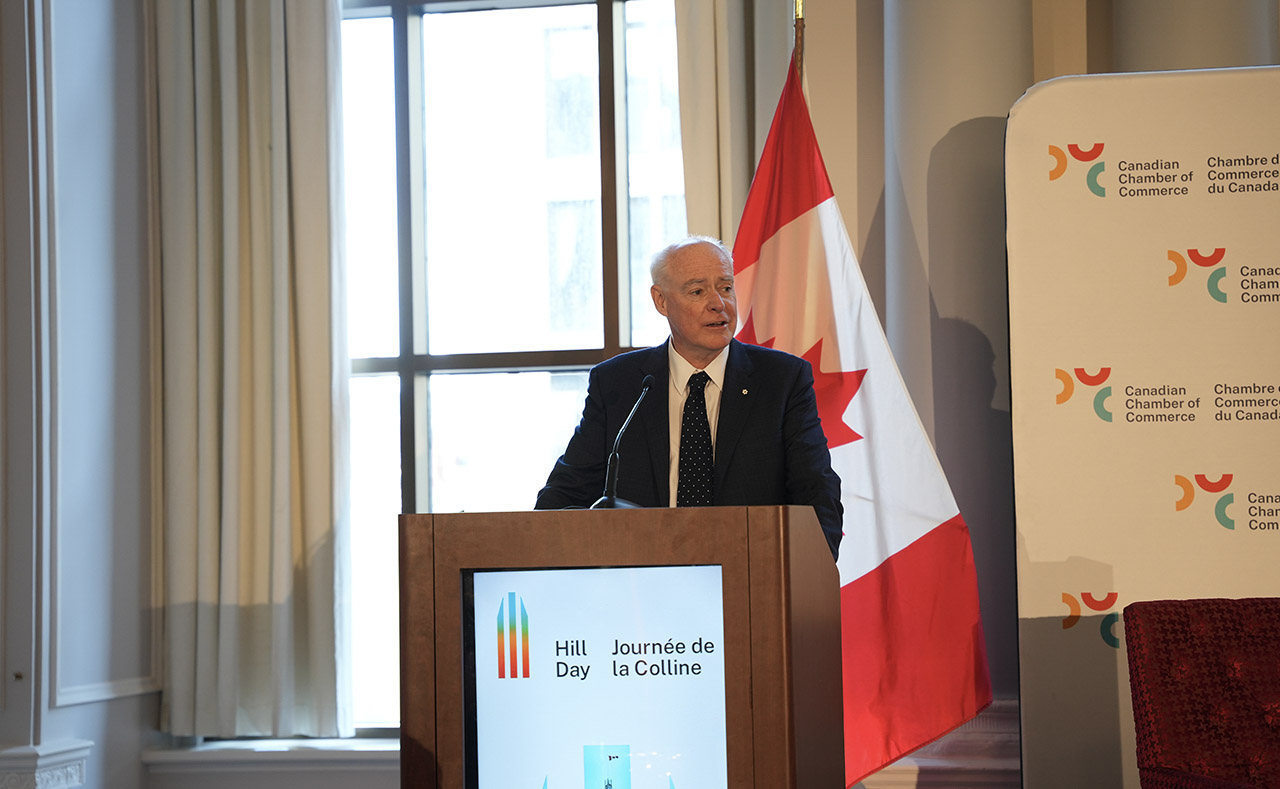

A Recap of the Canadian Chamber of Commerce’s 2024 Hill Day

A Recap of the Canadian Chamber of Commerce’s 2024 Hill Day

A platform for business leaders from diverse sectors across Canada to come together and directly engage with parliamentarians and government officials on pressing policy issues impacting Canadian businesses.

The Canadian Chamber of Commerce’s 2024 Hill Day, held on April 15 and 16 at the Fairmont Chateau Laurier in Ottawa, once again provided a platform for business leaders from diverse sectors across Canada to come together and directly engage with parliamentarians and government officials on pressing policy issues impacting Canadian businesses.

With an impressive lineup of distinguished speakers and engaging sessions, as well as several advocacy meetings, this year’s Hill Day emphasized the critical role of strategic investments and innovative thinking in shaping Canada’s future.

Day 1 Highlights:

A Breakfast With the Honourable Dominic LeBlanc, Minister of Public Safety, Democratic Institutions and Intergovernmental Affairs of Canada

The day started with a captivating keynote address from Minister Dominic LeBlanc. His remarks centred on the delicate balance between transparency and security in addressing foreign conflicts. He outlined strategies aimed at enhancing intelligence flow and safeguarding critical infrastructure — crucial elements in maintaining national security.

Additionally, Minister LeBlanc announced the launch of the new Canadian Internal Trade Data and Information Hub (CITH), a resource that promises to significantly benefit businesses across Canada. This initiative was a direct response to our longstanding call for reliable and timely data on internal trade and labour mobility.

A Lunch With the Honourable François-Philippe Champagne, Minister of Innovation, Science and Industry of Canada

During the luncheon session, Minister Champagne provided valuable insights into the post-pandemic landscape and articulated the government’s strategy for economic growth and affordability, emphasizing the need for a pro-growth approach to enhance Canada’s global competitiveness. His remarks underscored the government’s commitment to fostering an environment conducive to investment, thereby driving economic growth and ensuring prosperity for all Canadians.

The Right Honourable Justin Trudeau, Prime Minister of Canada

Prime Minister Trudeau’s address provided some insight into Budget 2024 ahead of its release and underscored the importance of intergenerational opportunity. He emphasized Canada’s role as a global leader, particularly in the realms of innovation, artificial intelligence, clean energy and technology. His remarks resonated strongly, emphasizing the critical role that proactive engagement plays in shaping a brighter future for Canada and the world. You can watch his address here.

Kristen Hillman, Ambassador of Canada to the United States

Ambassador Kirsten Hillman’s remarks emphasized the significance of Canada-U.S. relations, particularly with the upcoming negotiations related to the Canada-United States-Mexico Agreement (CUSMA). Her insights explored strategies to enhance economic and national security, highlighting the critical role of strong partnerships and collaboration between the two countries.

Jasraj Singh Hallan, M.P., Conservative Shadow Minister for Finance and Middle Class Prosperity

Day 1 concluded with an address from MP Jasraj Singh Hallan, who shared the Conservative Party’s vision for economic growth across Canada. He emphasized the need for fiscal responsibility, less taxes, and regulatory reforms to ensure a more competitive business environment and make life more affordable for Canadians.

Day 2 Highlights:

The Pundits Panel

Day two kicked off with a lively panel discussion featuring political thought leaders Kate Harrison, Kathleen Monk and Tyler Meredith. Moderated by the Canadian Chamber’s Senior Vice President of Policy and Government Relations, Matthew Holmes, the panel provided a comprehensive overview of the current political climate, key policy issues facing Canadian businesses and insights into the upcoming federal elections.

Closing the Event With the Honourable James Moore

The Honourable James Moore concluded the event with engaging insights into the political landscape, Canada-U.S. relations, economic challenges and the vital relationship between business and government.

Advocacy Meetings

Structured around specific themes, the meetings delved into crucial aspects of the economy such as international policy and trade, reliable supply chains, environmental and natural resources, an innovative economy, industry competitiveness and building stronger communities. These discussions not only identified the primary challenges and opportunities within each sector but also underscored the importance of collaboration between government and businesses.

In total, we held 34 meetings, engaging with notable figures including Kirsten Hillman, Canada’s Ambassador to the United States, Senator Colin Deacon, Minister Anita Anand, and MP George Chahal, Chair of the Standing Committee on Natural Resources. These meetings were complemented by engagements with representatives from 10 different government departments, which highlighted the importance of collaboration and partnership between government bodies and businesses to address challenges and seize opportunities in various sectors.

International Policy and Trade

The International Policy & Trade group met with Canada’s Ambassador to the United States, Kirsten Hillman, Senator Peter Boehm, MP Randy Hoback, and others from Global Affairs Canada and the Office of the Minister of Foreign Affairs.

Reliable Supply Chains

The Reliable Supply Chains group met with the Head of Transport Canada’s National Supply Chain Office Robert Dick, and others from Canada Border Services Agency and the Privy Council Office.

Environment and Natural Resources

The Environment and Natural Resources group met with Deputy Minister of Natural Resources Canada Michael Vandergrift, MP George Chahal, Assistant Deputy Minister of Environment & Climate Change Canada, John Moffet, and others from the Net-Zero Advisory Body and the Canadian Climate Institute.

Innovative Economy

The Innovative Economy group met with Senator Colin Deacon, MP Brian Masse, and others from Innovation, Science and Economic Development (ISED) and the Canadian Centre for Cyber Security.

Industry Competitiveness

The Industry Competitiveness group met with Minister Anita Anand, and others from the Privy Council Office, Treasury Board Secretariat, and Innovation, Science and Economic Development (ISED).

Stronger Communities

The Stronger Communities group met with Deputy Minister of Employment and Social Development Paul Thompson, MP Tracy Gray, and others from the Office of the Minister of Employment, Office of the Minister of Families, and Immigration, Refugees and Citizenship Canada (IRCC).

Hill Day is one of the Canadian Chamber’s most anticipated events of the year — and for good reason. The conversations, meetings and transparent discussions had between members of the private sector and representatives of the public sector play a role in determining the future of business success and building a better life for all Canadians.

To access photos from your selected session, please click the corresponding button below.

Day 1

Day 2

Thank You to Our Event Sponsors

Thank You to Our Excellence Level Partners

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

Canadian Chamber Addresses Regulatory Burden on Canadian Businesses Before OGGO Committee

Canadian Chamber Addresses Regulatory Burden on Canadian Businesses Before OGGO Committee

On April 10, 2024, we addressed the pressing issue of the regulatory burden on Canadian businesses before the OGGO Standing Committee on Government Operations and Estimates.

On April 10, the Canadian Chamber of Commerce’s Senior Director, Manufacturing and Value Chains, Alex Greco, appeared before the OGGO Standing Committee on Government Operations and Estimates, to highlight the pressing issue of regulatory burden on Canadian businesses.

While Canada was ranked 4th in the world for ease of doing business in 2006, it has since slipped to 23rd (as of 2020), primarily due to the increasing burden of government regulations. This stifling regulatory environment, now ranked 53rd globally, is impeding economic growth and investment.

We need a more ambitious approach from the government to accelerate modernization and streamline regulatory processes. The current complex and slow-moving regulatory environment is driving up operating costs for businesses, particularly small businesses, which lack the resources to navigate these challenges effectively.

In his remarks, Greco proposed three key recommendations to the committee:

- implementing an economic and competitiveness mandate for federal regulators,

- ensuring regulatory alignment across domestic and international jurisdictions, and

- providing regulatory certainty to businesses through evidence-based regulations.

He emphasized that these measures are crucial to create an environment where businesses can thrive and contribute to Canada’s economic success.

The video recording and full remarks can be seen below.

Mr. Chair, Honourable Members:

It is a pleasure to appear before you on behalf of 400 chambers of commerce and boards of trade and more than 200,000 businesses of all sizes from all sectors of the economy and from every part of the country.

It will come as no surprise that regulatory burden continues to be a growing concern for Canadian business. The World Bank’s “Ease of Doing Business” report ranked Canada as 23rd in 2020—but we were 4th in the world as recently as 2006. A big part of this decline is we’re now ranked 53rd for the burden of government regulation on business. Regulation is literally stifling our economy.

It goes without saying that the right policy environment can help businesses succeed and generate long-term economic growth for the country. Making Canada an attractive destination for business investment that supports economic growth requires getting the fundamentals right.

At a time when inflation is persistent, government and the private sector must look at new ways to make Canada more competitive. Governments in the past have attempted to regulate our industries into a more competitive frame, but this has had the opposite effect, as the costs of starting and growing a business have become a disincentive to investment.

The regulatory burden is troublesome in several ways, but two stand out. First, we can’t continue to move at a snail’s pace – we need the government to be more ambitious. We need the government to accelerate modernization and ensure approvals and permitting can meet our public policy ambition.

Second, the ongoing ability of companies to comply with complex regulations is increasing operating costs. It is consistently one of the biggest barriers to economic growth.

According to the SME Regulatory Compliance Cost report, the total regulatory compliance cost to small businesses was nearly $5 billion in 2011, which at the time was approximately $3,500 per business.

That number has no doubt increased over the past decade along with the regulatory burden overall.

We cannot afford for more private sector investment decisions to be sidelined because of the complex regulatory environment in Canada. Too often, we hear from our members about the investments they have on hold while they wait for direction from the government. Lack of clarity and speed on the new investment tax credits is a good example: while other jurisdictions, such as the United States move quickly to create the conditions for investment, Canada is falling behind. Investment will not wait – it will go where it is wanted.

Many members also cite increased red tape and differing certification and technical standards as major obstacles to doing business within Canada.

Complying with a complex network of overlapping regulations from all levels of government is expensive and time-consuming. When combined with inefficient and unpredictable regulatory processes, this sets businesses up for failure.

All of these issues are especially potent for small businesses, which usually lack the resources of larger companies to manage regulation and compliance.

While I commend the government for pushing a regulatory modernization agenda, we must move more boldly and urgently. We cannot just talk the talk—we need to see real action that will move the needle.

In the time remaining, I would like to focus on three recommendations for the committee.

First, the government must move to implement an economic and competitiveness mandate to federal regulators.

Too often, regulators do not fully consider economic impacts on business when making decisions.

Second is regulatory alignment across domestic and international jurisdictions.

When regulations are more consistent between jurisdictions, businesses are better able to trade within Canada and beyond. Quite simply, we should not require a “Free Trade” agreement within our own country.

Unless the government actively works to improve collaboration and alignment to ensure businesses are not at a disadvantage, we will see less innovation, fewer choices, and higher prices.

An example of this is when each province establishes its own framework for regulating pesticides or rules for the trucking of goods across jurisdictions.

Finally, the government should pledge to provide regulatory certainty to businesses.

Evidence-based regulations can both protect the public interest and promote market success.

And for companies looking to invest billions of dollars in developing new pipelines, new mines, and other large-scale infrastructure projects, this is not a “nice to have”. It is a “must-have.”

In closing, Canada needs smarter regulatory systems, better processes, and well-designed regulations to help minimize the costs to business and unlock economic growth while improving public health and safety outcomes.

Sustained collaboration with all levels of government and our international partners will make it easier for businesses to do what they do best—produce.

Thank you.

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians

5 Minutes for Business: There is no low carbon economy without a regulatory system that works

Blog /

The Canadian Chamber Addresses Bill C-59 Before Senate Committee

The Canadian Chamber Addresses Bill C-59 Before Senate Committee

On March 20, 2024, we addressed Bill C-59 and the importance of Canada’s economic competitiveness and productivity before the Senate Committee on National Finance.

On March 20, the Canadian Chamber’s Senior Vice President of Policy and Government Relations, Matthew Holmes and Senior Director, Fiscal and Financial Services Policy, Jessica Brandon-Jepp appeared before the Senate Committee on National Finance to address Bill C-59. They emphasized the importance of Canada’s economic competitiveness and productivity — noting that Canada’s productivity has declined in 11 of the last 12 quarters — and highlighted the need for businesses to be viewed as critical partners in driving investment and growth to address these challenges.

Focusing their comments on competition policy, investment tax credits and the digital services tax proposed in Bill C-59, they expressed concerns about changes to the Competition Act and recommended specific safeguards for new “private rights of action” to prevent frivolous claims.

The full remarks and video recording can be viewed below.

*The following remarks were adjusted slightly in the final delivery.

Mr. Chair, Honourable senators:

It is a pleasure to appear before you again on behalf of 400 chambers of commerce and boards of trade, and more than 200,000 businesses of all sizes, from all sectors of the economy and from every part of the country.

The Canadian Chamber of Commerce’s primary concern this evening is that Canada’s economic competitiveness is slipping, while our productivity has declined in 11 of the last 12 quarters. This means Canadians are poorer overall, have fewer opportunities to pursue their personal goals, and have to spend more just to keep up with everyday life.

Businesses of all sizes should be viewed by government as critical partners in our collective success, which can drive investment and growth, and help turn the tide on our productivity challenges.

The committee has already received our formal submission on C-59, which included seven specific recommendations and proposed amendments: tonight we will focus our comments tonight on competition policy, investment tax credits, and the digital services tax:

First, competition policy:

As we raised during your study of C-56, we remain concerned by the ad hoc approach to changes to the Competition Act and would encourage the government to continue to consult with the business community on changes to the Act.

In particular, C-59 could overwhelm the Competition Tribunal and businesses with frivolous claims through new “private rights of action”. The Canadian Chamber’s submission recommends specific safeguards consistent with Canadian class action statutes to ensure claims are evaluated on a consistent basis, and funds are properly distributed to the consumers affected by the conduct, rather than their lawyers.

Recently there has been a lot of talk about structural presumptions in merger reviews: we saw the Competition Bureau file a brief with this committee advocating for its inclusion in C-59 pointing to the U.S. merger guidelines as inspiration. We are aware of the U.S. Chamber of Commerce’s letter to this Committee on the matter, and would encourage you to review it carefully as structural presumptions are not codified into US law, and there is no serious legislative attempt in the U.S. Congress to make structural presumptions the law. Competition agencies should continue to comprehensively examine a merger’s likely efforts on competition and consumers, including arguments that the merger would benefit consumers.

Second, Canada’s new investment tax credits:

Overall, the Canadian Chamber applauds new investment tax credits like the CCUS ITC as tools to unlock private sector investment in a low-carbon economy. In order to maximize the impact of the Clean Technology Manufacturing Tax Credit and Investment Tax Credit, we recommend they be refined to include intangible property and mine development investments.

Further, we believe the Clean Technology ITC should be expanded to include life insurers, similar to the Fall Economic Statement inclusion of Real Estate Investment Trusts. Life insurers often manage assets on behalf of pension plans. However, because pension plans are non-taxable entities, long-term investors cannot utilize the Clean Technology ITC, which will hamper long-term investment in the decarbonization of Canada’s economy.

Given the current uncertainty around the permitting environment in Canada, we also recommend extending the timeline for phasing-out the Clean Technology Manufacturing ITC and Clean Electricity ITC in order to secure large investments within the Canadian mining, manufacturing and electricity sectors. Finally, it is imperative that all of the new ITCs are implemented as soon as possible, with clarity on procedure and eligibility, so that the private sector can fuel the next wave of long-term investment in our economy.

Which brings us to new corporate taxes and the digital services tax:

The irony is that just as we’re contemplating ITCs to spur private sector investment, innovation and growth, a range of new business taxes threaten to repel investment, create uncertainty, and discourage new players from entering the Canadian marketplace.

Specifically, we call on the government to avoid imposing new taxes on the business sector, as C-59 proposes to do with a Digital Services Tax. DST is particularly concerning as it includes a retroactive tax to 2022 on online services Canadians have come to rely on, even though over 120 countries, including the U.S., have agreed to delay imposing such taxes.

First, we strongly object to the concept of tax retroactivity, which robs businesses of the certainty they need to make productive investments in innovation and growth and has a chilling effect on future investment across the economy.

Second, we oppose any measure which will increase the costs for businesses and Canadians when both are facing challenging economic headwinds. This new tax will affect far more than just large multi-national corporations: if enacted, the DST will ripple across the Canadian economy to mom-and-pop shops, small businesses, rural tourism operators, and independent makers (primarily women) who help pay the bills through “side hustle” start-ups–not to mention all of us who enjoy picking up some takeout after a long work week or booking a stay-cation close to home.

In fact, this tax will disproportionately impact businesses with low profit margins because unlike corporate income taxes, digital services taxes are levied on revenues rather than profits. As a result, there is a disproportionate tax burden being placed on companies with low profit margins, such as the online travel sector.

Finally, we must sound the alarm that successive administrations in Washington have signalled that enacting a DST could provoke damaging trade retaliation, potentially against key sectors of the Canadian economy. We are hearing directly from businesses in many sectors beyond the digital services space who are concerned that their products may be impacted by retaliatory tariffs.

At a very minimum, we call for the punitive and retroactive application of the DST to be cancelled, and the introduction of a safe-harbour for low-margin businesses similar to OECD Pillar One, Amount A in which there is a safe harbour provision.

Bill C-59 and the forthcoming Budget 2025 presents an opportunity for decisive action. We urge Ottawa to adopt pro-growth policies that will invigorate Canada’s economy. As ever, we stand ready to facilitate collaboration between policymakers and the business community to make this happen.

Thank you.

Related News

Canadian Chamber of Commerce: A Year In Review

Pharmacare: Raising the Bar for Canadians